A slew of banks are coming together to back a new roll-up strategy for the Los Angeles-based mobile gaming studio, Jam City and giving the company $145 million in new funding to carry that out.

There’s no word on whether the new money is in equity or debt, but what is certain is that JPMorgan Chase Bank, Bank of America Merrill Lynch and syndicate partners including Silicon Valley Bank, SunTrust Bank and CIT Bank are all involved in the deal.

“In a global mobile games market that is consolidating, Jam City could not be more proud to be working with JPMorgan, Bank of America Merrill Lynch, Silicon Valley Bank, SunTrust Bank and CIT Group to strategically support the financing of our acquisition and growth plans,” said Chris DeWolfe, co-founder and CEO of Jam City. “This $145 million in new financing empowers Jam City to further our position as a global industry consolidator. As we grow our global business, we are honored to be working alongside such prestigious advisers who share Jam City’s mission of delivering joy to people everywhere through unique and deeply engaging mobile games.”

The new money comes after a few years of speculation on whether Jam City would be the next big Los Angeles-based startup company to file for an initial public offering. It also follows a new agreement with Disney to develop mobile games based on intellectual property coming from all corners of the mouse house — a sweet cache of intellectual property ranging from Pixar, to Marvel, to traditional Disney characters.

Jam City is coming off of a strong year of company growth. The Harry Potter: Hogwarts Mystery game which launched last year, became the company’s fastest title to hit $100 million in revenue

Add that to the company’s expansion into new markets with strategic acquisitions to fuel development and growth in Toronto and Bogota, and it’s clear that the company is looking to make more moves in 2019.

Jam City already holds intellectual property for a new game built on Disney’s Frozen 2, the company’s newly acquired Fox Studio assets like Family Guy and the Harry Potter property. Add that to its own Cookie Jam and Panda Pop properties and it seems like the company is ready to make moves.

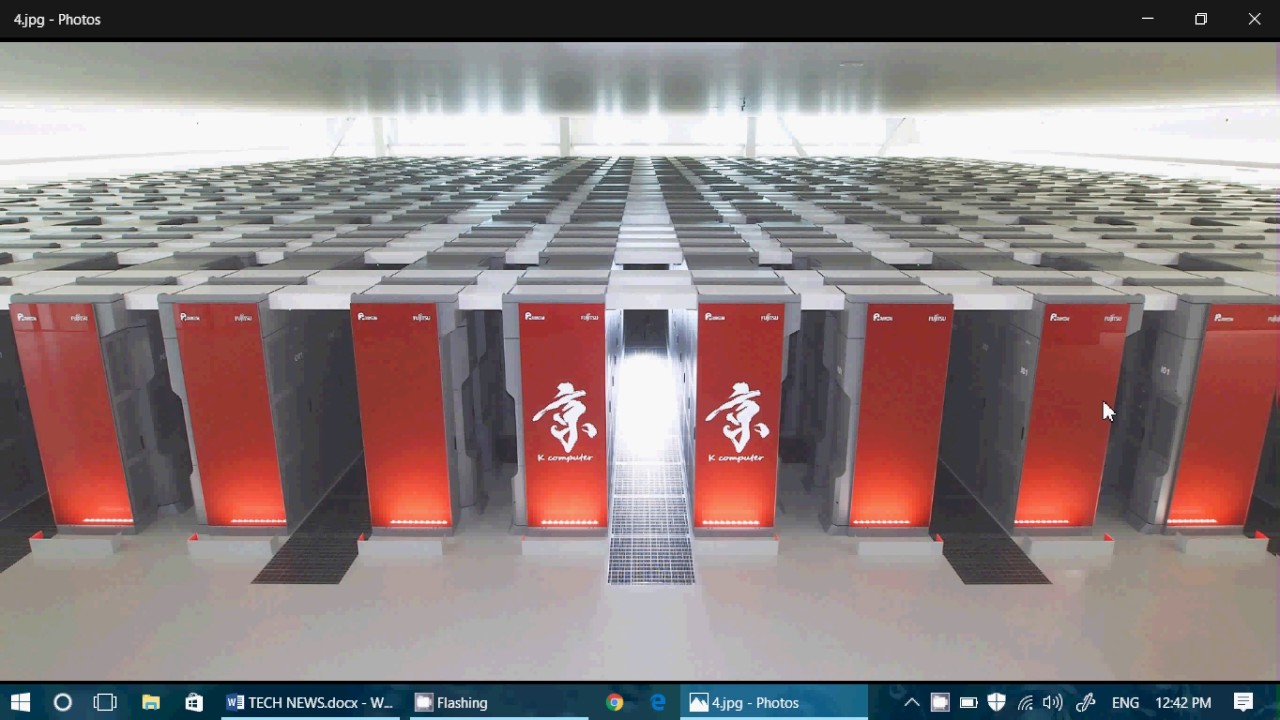

Meanwhile, games are quickly becoming the go-to revenue driver for the entertainment industry. According to data collected by Newzoo, mobile games revenue reached a record $63.2 billion worldwide in 2018, representing roughly 47% of the total revenue for the gaming industry in the year. That number could reach $81.3 billion by 2020, the Newzoo data suggests.

Roughly half of the U.S. plays mobile games and they’re spending significant dollars on those games in app stores. App Annie suggests that roughly 75% of the money spent on app stores over the past decade has been spent on mobile games. And consumers are expected to spend roughly $129 billion in the app store over the next year. The data and analytics firm suggests that mobile gaming will capture some 60% of the overall gaming market in 2019 as well.

All of that bodes well for the industry as a whole, and points to why Jam City is looking to consolidate. And the company isn’t the only mobile games studio making moves.

The publicly traded games studio Zynga, which rose to fame initially on the back of Facebook’s gaming platform, recently expanded its European footprint with the late December acquisition of the Helsinki-based gaming studio, Small Giant Games.

![]()

Jonathan Shieber

Source link