PARIS — When President Emmanuel Macron took office, he took pains to include two iPhones in his official portrait, a symbol of his penchant for technology. Millennials throng as he buzzes from one French start-up event to the next. He has wined and dined the chief executives of the world’s largest tech companies, who in turn have vowed to invest billions in France.

Yet a year after Mr. Macron unveiled an aggressive agenda to turn France into “a start-up nation,” it is unclear if reality has kept pace with his rhetoric. While the country has quickly become one of the most talked-about destinations in Europe for tech companies and start-ups, France still faces an uphill path in its bid to usurp London as the region’s technology leader.

The French president has carefully cultivated a tech-savvy image, promoted a steady drumbeat of high-profile events, and even pushed through a raft of economic and labor reforms to make his country more appealing to investors. But France continues to lag Britain in tech-related investments and in the business of artificial intelligence. Start-ups still face challenges in scaling up. And a lot of seed funding comes from the French government itself.

Companies have been pledging to do more in France. In January, for example, the chief executives of the world’s biggest technology companies announced 3.5 billion euros, or $4.1 billion, in new investments and the creation of at least 2,200 jobs in the next five years.

Those figures are minuscule compared with investment in Silicon Valley, and even London. Mr. Macron nevertheless sought to build on France’s momentum on Wednesday, when he convened 60 tech chief executives for meetings in Paris. The French president is set to meet individually with the Facebook chief executive, Mark Zuckerberg, as well as with the leaders of IBM, Microsoft and Uber later Wednesday at the Élysée Palace.

The talks, ahead of a giant technology and start-up conference being held in Paris, will officially focus on data privacy issues. They come a day after Mr. Zuckerberg faced strident questioning by lawmakers at the European Parliament in Brussels on privacy failures linked to the Cambridge Analytica fiasco.

Facebook has faced a barrage of public criticism over its handling of user data and vast powers, points Mr. Macron intends to press further on Wednesday. The president’s office also said that Mr. Macron would have frank discussions with the various chief executives over the taxation of tech companies and fighting the proliferation of rumors and misinformation spreading online. The meetings come as French lawmakers are expected to debate additional transparency measures for social media companies like Facebook.

But Mr. Macron president is also expected to seize the moment to announce more tech-related investments in France.

“Clearly there has been a Macron effect,” said Franck Sebag, a Paris-based partner at the professional services firm Ernst & Young, who has studied France’s digital trajectory.

“Few people were even talking about France as a tech country a few years ago,” Mr. Sebag said. “He’s ignited a willingness to invest.”

As President Trump pursues an increasingly protectionist agenda for the United States, and Britain veers away from the European Union, Mr. Macron has promoted a policy of open borders and being business-friendly in a country that has long had a reputation for being anything but. Multinationals are venturing to create more jobs in France as Mr. Macron overhauls French labor laws, despite protests by French workers.

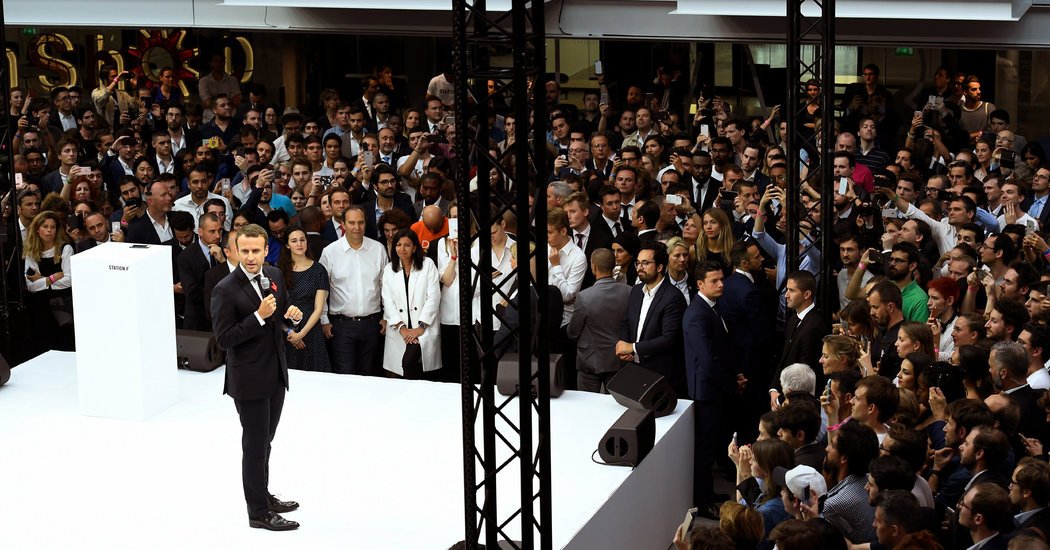

Symbolic statements, like the opening last year of Station F, a mammoth incubator project in Paris representing France’s start-up ambitions, have also generated buzz. And the government is luring research activity with tax credits worth up to €5 billion a year and other inducements. This month, Mr. Macron announced France would invest €1.5 billion into artificial intelligence research through 2022.

Venture capital — once difficult to raise in a country where risk-taking was long stigmatized — is flowing more freely. Venture capital fund-raising for start-ups rose to €2.7 billion last year, compared with just €255 million in 2014, according to Dealroom, a research firm. That latest figure is more than amounts raised in Britain, as well as Germany and Israel, which also have major tech hubs.

“The U.K. is no longer the undisputed capital of European venture capital,” Dealroom said in a recent report. “Continental Europe is catching up, while France is almost on par already.”

For all the hype, France must confront a number of longstanding hurdles.

While thousands of start-ups are being developed in incubators like Station F, the country has only a handful of so-called unicorns, or start-ups valued at over $1 billion, including the ride-sharing service BlaBlaCar and the e-commerce site Vente-Privee.com. That is a measure of how challenging it is to create the next Facebook or Google here. And fledgling companies still face considerable challenges scaling up into bigger, sustainable businesses.

Tech-related investments in Britain, meanwhile, surged nearly 90 percent last year to over €7 billion, more than in France, Germany and Sweden combined, according to Dealroom. And though France makes billions in cheap loans and grants available to finance start-ups and accelerators through its public investment bank Bpifrance, critics say that can make it hard to tell if French start-ups are competitive.

Mr. Macron’s efforts to make France a hub for artificial intelligence research have also been slow to make headway. Britain still has the strongest A.I. ecosystem in Europe, with over 120 firms involved in the technology, compared with 39 in France, according to Asgard Capital, a Berlin-based venture capital firm.

The trend here is shifting, though.

Big businesses are increasingly tallying the advantages, especially since Mr. Macron convened 140 chief executives of global companies at an ornate gathering at the Palace of Versailles in January. He told them that he was pursuing a strategy to make France more productive and competitive, and announced more than €3.5 billion in foreign investments, including a large chunk for tech.

IBM announced Wednesday it would recruit 1,800 artificial intelligence experts in France by 2020. SAP of Germany plans to invest €2 billion in research and development. DeepMind, the London-based machine learning company owned by Google’s parent, Alphabet, will expand its operations in Paris as Britain prepares to leave the European Union.

Facebook and Google also plan to beef up their French presence and their artificial intelligence teams in Paris over the next several years. And just before Mr. Macron’s official state visit with Mr. Trump this month, Salesforce, the American cloud computing company, announced a new $2.2 billion investment in its French business over the next five years.

Fujitsu of Japan is one of several Asia-based companies that plan to invest in expanded artificial intelligence research here. After the gathering in Versailles, the Fujitsu president, Tatsuya Tanaka, was named a chevalier of the Légion d’Honneur by the French government, one of France’s highest honors.

“The new image of France,” the company said in a statement, “is attracting foreign investors again.”

Follow Liz Alderman on Twitter: @LizAldermanNYT.

Elian Peltier contributed reporting.

By LIZ ALDERMAN

https://www.nytimes.com/2018/05/23/business/emmanuel-macron-france-technology.html

Source link