“Travel is expensive, but we are at the cusp of a revolution that will democratize travel and leisure for everyone,” reads the breathless whitepaper for HoweyCoins. “The Internet was the first part of the revolution. The other part is blockchain technology and cryptocurrencies.”

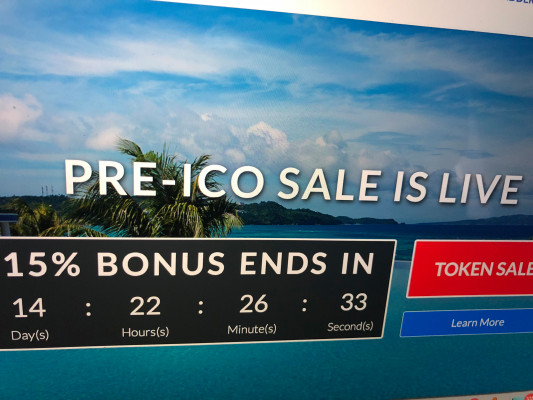

“I’m all about HoweyCoins – this thing is going to pop at the top!” writes @boxingchamp1934, an official celebrity backer of the token. The website is full of beautiful beaches, features a handsome team of international men and women and the technology is nowhere to be seen, buried under a sea of excitement. The whitepaper is complete and well-written, focusing on the upside that is to come. Riches await if you invest in HoweyCoin, the latest ICO opportunity from trusted folks.

Or do they?

They don’t. All that breathless optimism is a site created by US Securities Exchange Commission to warn investors of scams and issues associated with token sales. The site features all the trademarks of a scammy security token, including tiered pre-sale pricing and an urgent countdown clock.

The site features a number of red flags that the SEC encourages users to watch out for, including, most importantly, claims that tokens can only go up in value. They write:

Every investment carries some degree of risk, which is reflected in the rate of return you can expect to receive. High returns entail high risks, possibly including a total loss on the investments. Most fraudsters spend a lot of time trying to convince investors that extremely high returns are “guaranteed” or “can’t miss.”

The SEC also notes that “it is never a good idea to make an investment decision just because someone famous says a product or service is a good investment,” and that it is never a good idea to invest with a credit card.

They also warn against pump and dump language found on many ICO pages. “Our past two pumps have doubled value for the period immediately after the pump for returns of over 225%,” wrote the HoweyCoins “creators,” a giant no-no in the world of investing.

You can read the rest of the red flags here.

While the site is fairly comical, it is sufficiently complete and would fool the casual observer. The SEC also posted a real-looking whitepaper that makes it clear that anyone can string together a few buzzwords and write a passable investment prospectus. That this is now a service available to anyone — for a price — makes things even scarier.

The site is part of the SEC’s outreach efforts to help investors understand ICOs.

“Strong investor protection is part of what makes American markets so strong…and striking the balance, [between innovation and investor protection] is very important,” said Chief of the SEC Cyber Unit Robert Cohen at Consensus this week. During the same panel the SEC claimed its doors were always open for questions.

Ultimately there is little separating the scams from the real token sales. This is a problem. The SEC is framing this problem in their own way based on decades of dealing with pink sheet pump and dumps and bogus get-rich-quick schemes. While HoweyCoins may not be real, there are plenty of scammers out there, and at least something like this bogus website makes it easier to spot the warning signs.

John Biggs

http://feedproxy.google.com/~r/TechCrunch/JohnBiggs/~3/CKImrrhStfA/

Source link