The biggest hurdle to widespread lidar adoption is an economic one, and that is where the battle is being waged.

When Google initially started its autonomous vehicle research eight years ago, the lidar sensors it used cost roughly $75,000. Those sensors were made by Velodyne Lidar, an industry leader. Velodyne declined to say what the current pricing is for such systems, but Waymo’s chief executive, John Krafcik, said in a recent presentation that his company had reduced the cost of its lidar system by 90 percent.

But even at $7,500, such systems are seen as too expensive to meet automakers’ demands.

“Car companies want it to cost $100 and perform 10 times better, be smaller — and very reliable,” said Omer Keilaf, chief executive of Innoviz Technologies, a lidar developer based in Israel. “So there’s a big vacuum in the industry right now.”

The race to fill that void is largely focused on producing solid-state lidar systems, which would shrink the size of the sensors, eliminate moving parts involved in the optical mechanisms and enable the kind of mass manufacturing that could bring costs down, said Hongbo Zhang, a research associate at Virginia Tech who is working on a lidar design. Established automotive suppliers, such as Velodyne and Valeo; technology companies like Waymo and Uber; and relative newcomers like Innoviz, LeddarTech and Quanergy all have their sights set on making less expensive sensors.

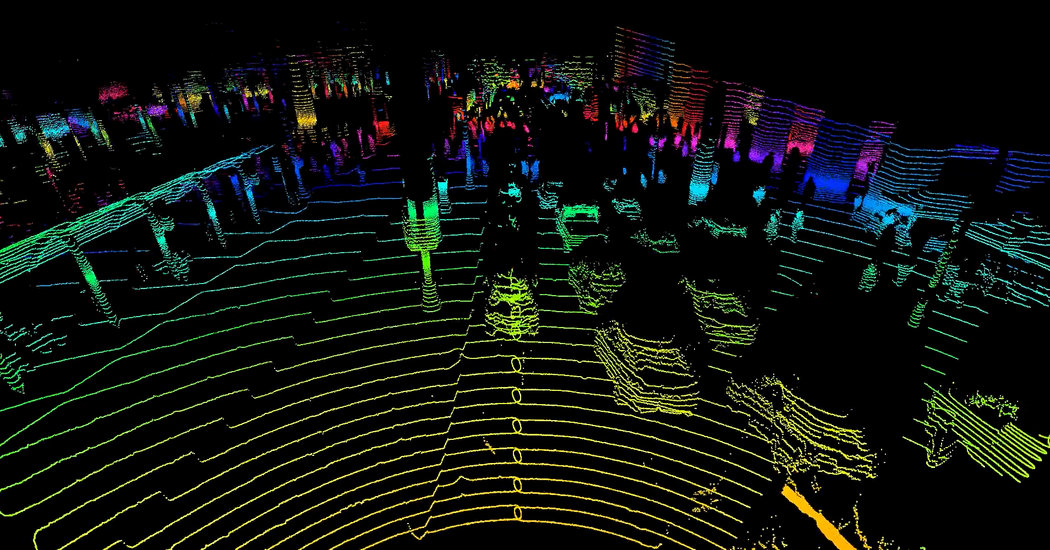

Graphic

The Race for Self-Driving Cars

There are increasing signs that autonomous cars have arrived — and may be driving on our city streets sooner than we think.

Solid-state lidars tend to have a reduced field of view, about 120 degrees compared with the 360-degree view offered by rooftop models. “So to create a cocoon around the car, you need to integrate four to six solid-state lidar sensors,” said Marc A. Morin, a spokesman for LeddarTech.

But most of the researchers working on these designs still believe they can produce them for much lower prices, and Hyundai has demonstrated in its Ioniq autonomous test cars how such sensors could be made less conspicuous and concealed in the bumpers and roof pillars of vehicles.

Luminar Technologies, a lidar company that recently came out of stealth mode, is focusing on improving the performance of sensors by extending the effective range of lidar past 200 meters. (Top-of-the-line sensors now have a range of 120 meters.) Austin Russell, Luminar’s chief executive, said the company accomplished the longer range by using a more sensitive receiver, as well as a more powerful light output that remains safe enough to avoid damaging people’s vision.

Velodyne, which says it is the only current third-party lidar supplier for fully autonomous vehicles now being tested, is well aware that start-ups are gunning for its business. Velodyne is working on its own solid-state Velarray lidar sensor, said Mike Jellen, Velodyne president, and it plans to start mass-producing them next year in a 200,000-square-foot factory in San Jose, Calif.

While there has been considerable speculation about how Velodyne will face the potential price competition, Mr. Jellen declined to estimate how much the new sensors might cost, saying only that a complete lidar sensor package for future vehicles might be priced in the “low thousands” per vehicle.

Other companies building complete autonomous driving packages expect prices to fall faster.

“In five years, for ride-sharing cars, it could be an $8,000” option, said Jeffrey Owens, chief technology officer for Delphi. Delphi recently announced it was working with Intel, BMW and Mobileye on an autonomous driving platform. “In 2025, it could be $5,000,” he said.

“The problem is that we’re still in A.I. learning mode and only buying in quantities of a couple thousand,” said Velodyne’s Jellen, referring to artificial intelligence. “The problem is, the market isn’t there yet.”

There are also some technical kinks that need to be ironed out with new systems. Different versions of lidar paint images of the world around them in different ways, said Mr. Zhang at Virginia Tech. That means different lidar sensors from different companies cannot simply be exchanged for one another on an autonomous BMW or Ford vehicle. How a car is trained and learns will partly depend on the specific type of lidar used.

In spite of these challenges, Mr. Keilaf of Innoviz and many others say there will not be fully autonomous cars without lidar — and it will have to be cheap.

It will also have to meet exceptionally high standards.

“An autonomous vehicle that’s 99 percent safe won’t be good enough,” said Mr. Russell of Luminar. “This is mission critical. You can’t afford to miss a single object because that object could be a person.”

By JOHN R. QUAIN

https://www.nytimes.com/2017/05/25/automobiles/wheels/lidar-self-driving-cars.html

Source link