Facebook is still in the middle of its House Intelligence Committee hearing about Russian election interference, but the looming concerns over misuse haven’t dampened its business as profits continue to soar and its share price hits an all-time high.

Still, CEO Mark Zuckerberg saw it fit to break from his traditional “Our business is doing well” script to add “But none of that matters if our services are used in ways that don’t bring people closer together. We’re serious about preventing abuse on our platforms. We’re investing so much in security that it will impact our profitability. Protecting our community is more important than maximizing our profits.”

But those changes haven’t hit Facebook’s profitability yet, as it climbed 79% year-over-year to $4.7 billion. Facebook’s announced Q3 2017 earnings today, continuing its streak of beating estimates. Facebook earned $10.3 billion in revenue and $1.59 GAAP actual earnings per share, compared to estimates of $9.84 billion in revenue and $1.28 EPS. Facebook’s EPS is up 76% year-over-year, showing how efficient of a money-maker it’s become.

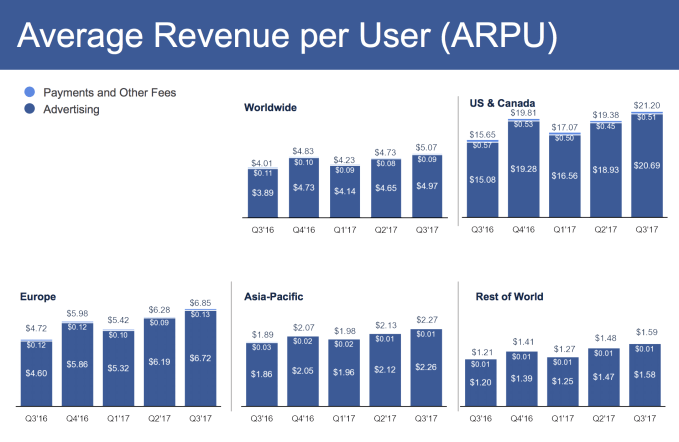

Revenue growth was 47% year-over-year compared to 59% in Q3 2016, which matches Facebook’s warnings that it’s running out of space to show ads. Mobile as a percentage of Facebook’s ad revenue inched up from 87% to 88% this quarter as it reaches a stabilization point in its successful shift to mobile. Average revenue per daily active user reached $7.51 vs $5.95 a year ago. That 26% increase shows how even as Facebook’s daily user growth has grown a more modest 16% over the year, Facebook has found better and better ways to squeeze money out of people.

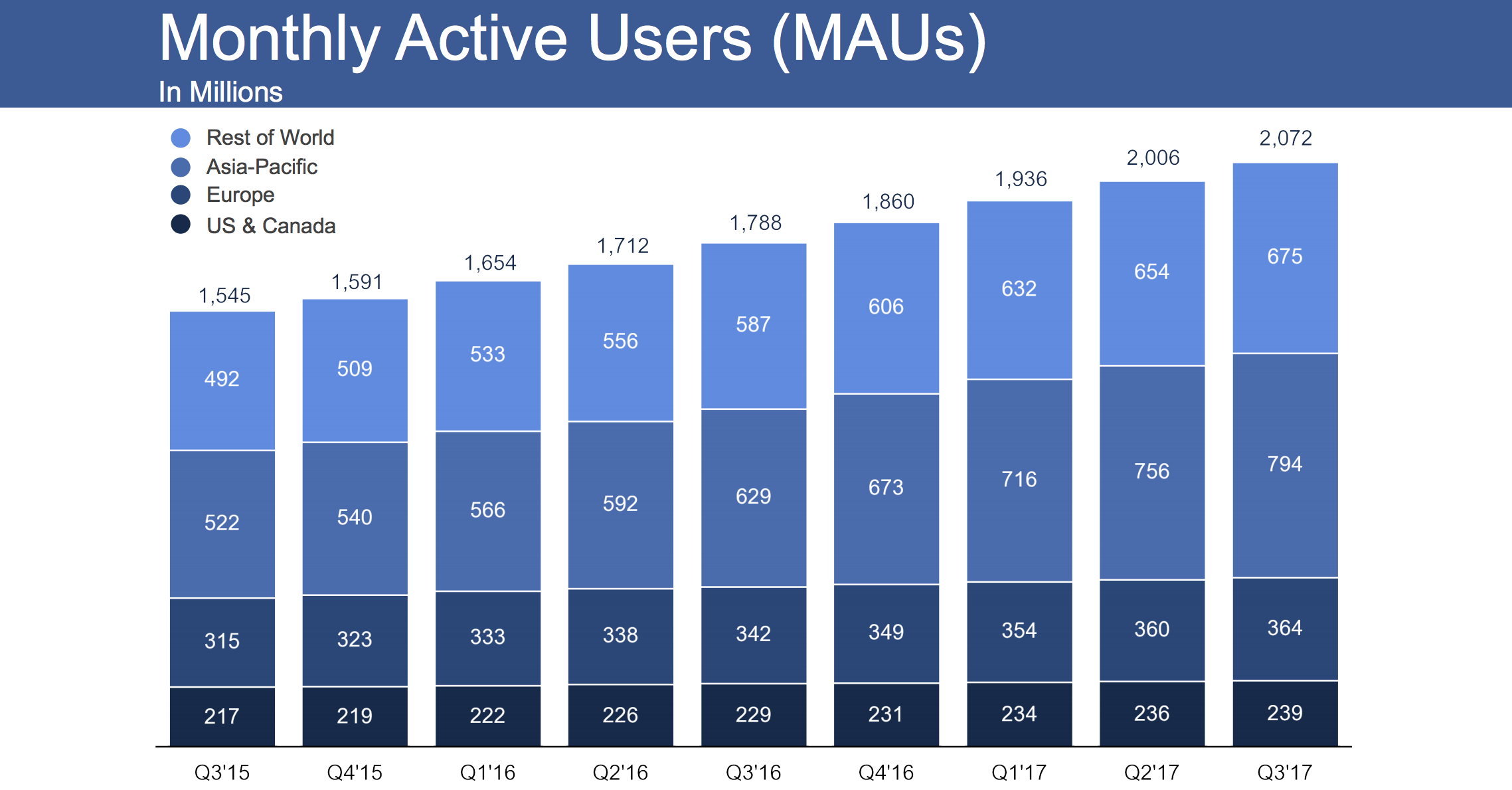

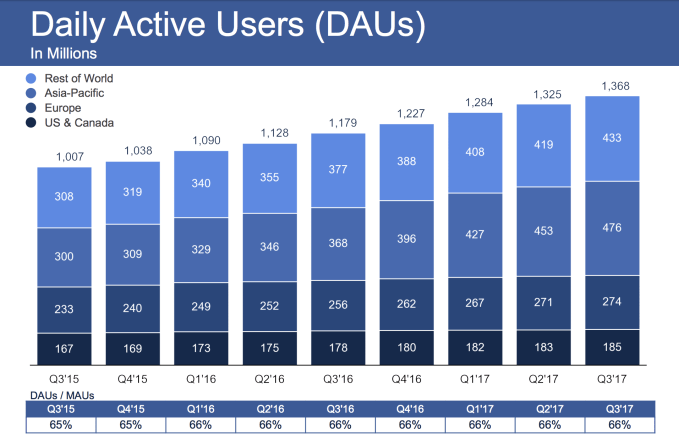

As for users counts, Facebook now has 2.06 billion monthly active users, up 3.19% compared to last quarter’s 2.006 billion and 3.4% growth rate. Daily active users reached 1.37 billion, up 3.8% quarter-over-quarter. Facebook’s stickiness, or the percentage of monthly actives users that return each day has stayed flat at 66% since Q1 2016. But that’s actually a great success, since most apps grow less sticky over time as users churn and the less engaged long-tail signs up.

Facebook’s share price had closed at $182.66 prior to the earnings announcement, and climbed 1.28% in after-hours trading. Facebook has a full war chest in case it wants to make any big acquisitions, with $38.29 billion in cash marketable securities at the end of Q3 2017.

Earnings Call Highlights

During the earnings call, Zuckerberg voiced his support for potential government regulation of ads transparency, saying he thinks it would be “very good if it’s done well”, even as Facebook attempts to self-regulate.

CFO David Wehner says Facebook will boost its expenses 45% to 60% in 2018 in order to fund security efforts following the Russian intrusion, as well as original video, AI, VR, and AR. Facebook will hire 10,000 people to monitor content and ads, though some will be contractors, and it plans to double its security engineering work force.

Zuckerberg says that Instagram Stories and WhatsApp Status both now have 300 million daily active users, up from 250 million in June and July respectively. That means these Snapchat clones are nearly 2X as big as the entire Snapchat app, which has 173 million daily actives.

While the business is shinging, in the press it’s been a grim few months for Facebook as it’s scrambled to improve its abuse detection systems following Russian election interference. Meanwhile, it’s scared news publishers with tests of a News Feed that removes all Pages and places them in a separate, buried feed. But prioritizing the user experience has allowed Facebook to continue to thrive amidst its many challenges and widespread public backlash.

Josh Constine

http://feedproxy.google.com/~r/techcrunch/facebook/~3/873zUtLRybc/

Source link